|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

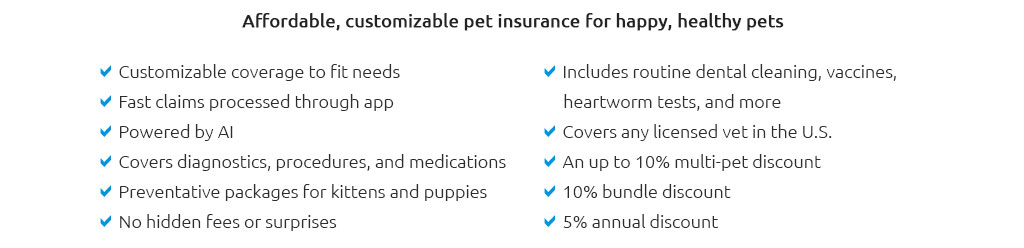

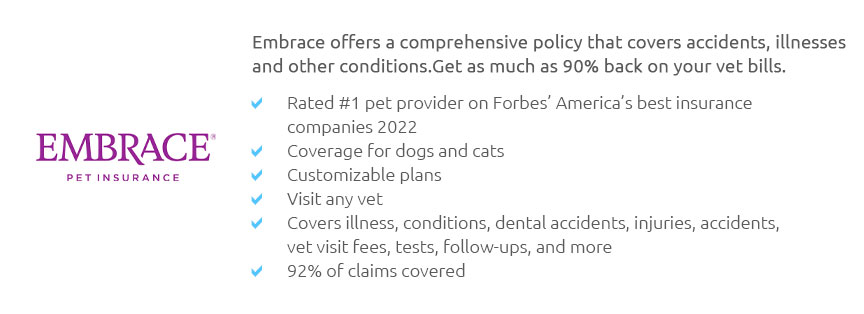

Understanding Pet Insurance in Connecticut: A Comprehensive GuideIn recent years, pet insurance has emerged as a significant consideration for pet owners in Connecticut. As the state experiences a burgeoning interest in animal welfare and pet care, understanding the nuances of pet insurance becomes crucial. This article seeks to unravel the complexities of pet insurance, offering a detailed exploration of its benefits, challenges, and the specific context within Connecticut. Pet insurance, at its core, functions as a safety net, offering pet owners financial relief in the face of unexpected veterinary expenses. In Connecticut, where veterinary costs can be relatively high due to advanced medical facilities and services, having insurance can be a prudent choice. The typical coverage includes accidents, illnesses, and in some cases, preventive care. However, the specifics can vary significantly from one provider to another, necessitating a careful examination of available options. The advantages of securing pet insurance are manifold. Primarily, it offers peace of mind, allowing owners to make healthcare decisions for their pets based on need rather than cost. Additionally, with the increasing costs of veterinary care, insurance can mitigate financial strain, ensuring that pets receive the necessary treatments without delay. In Connecticut, where pet culture is vibrant and diverse, such financial protection can be invaluable.

Despite these benefits, there are certain challenges and considerations. One significant factor is the cost of premiums, which can vary based on the pet's breed, age, and health condition. In Connecticut, where living costs are generally high, finding an affordable yet comprehensive plan can be a challenge. Additionally, understanding the terms and conditions of each policy is crucial to avoid unexpected exclusions or limitations. It's advisable for pet owners to thoroughly research and compare plans, taking into account factors such as reimbursement levels, deductibles, and coverage limits. Furthermore, the choice of insurer is pivotal. In Connecticut, a range of insurance providers offers varied plans, each with distinct features. Evaluating the reputation and reliability of these providers can be beneficial. Customer reviews, expert recommendations, and industry ratings serve as valuable resources in making an informed decision. In conclusion, pet insurance in Connecticut represents a valuable investment for pet owners, offering financial protection and ensuring access to essential healthcare services. As pet ownership continues to rise in the state, the importance of understanding and securing appropriate insurance coverage cannot be overstated. While challenges exist, particularly regarding cost and policy complexity, the peace of mind and security afforded by pet insurance make it a worthy consideration for any pet owner. Ultimately, informed choices, tailored plans, and a clear understanding of individual pet needs will lead to optimal outcomes, both financially and in terms of pet health and wellbeing. https://newingtonvet.com/pet-insurance/

The AVMA endorses the concept of pet health insurance to help defray the cost of veterinary medical care and we strongly agree with their recommendation. Many ... https://www.brookstoddmcneil.com/personal/pet-insurance/

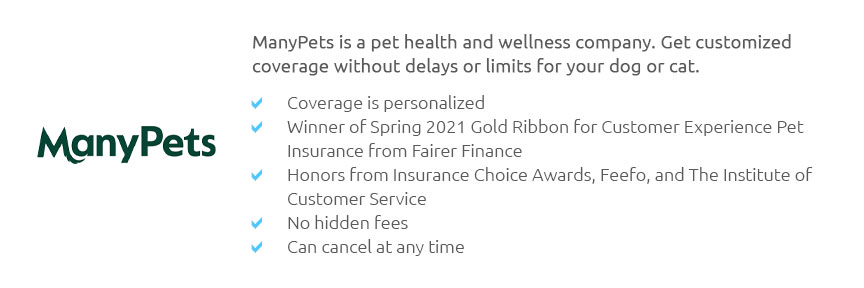

Pet insurance plans come with an annual deductible and prices vary depending on the breed and other factors such as reimbursement rate and policy terms and ... https://manypets.com/us/states/connecticut/

ManyPets is here to help, in Connecticut and all around the country. Our insurance plan covers both accidents and illnesses with no annual or lifetime payout ...

|